Managing Your Finances: How To Manage Your Small Business Finances

Managing your small business finances is arguably one of the hardest and most important things you need to successfully do. A recent study done by US bank listed the reasons why small businesses fail and the results were quite surprising.

Why Small Businesses Fail?

According to research done by U.S. Bank and cited by SCORE/Counselors to America’s small business the major reason most small businesses failed was due to poor financial management.

- 82% – Poor cash flow management

- 79% – Underfinanced in the startup phase

- 78% – Lack of well developed business plan

- 77% – Improper prices for services or products

- 73% – Being overly optimistic about sales

These are all preventable and knowing how to manage your small business finances can help make sure your business is profitable for the long run.

Table of Contents

Why Should You Manage Your Your Finances?

Good financial management is essential for any business, regardless of its size. Poor financial management can be costly in the long run, leading to cashflow issues, debt, bankruptcy, and even litigation. On the other hand, having an organized approach to managing your finances will ensure you know where and how your money is being spent. This gives you the power to make positive moves and decisions that will grow your business over time with minimal risk. Additionally, keeping on top of your financials will give you peace of mind – knowing that your accounts are up-to-date and take care of reduces stress and helps you focus on what matters most: running a successful business. When managing small business finances, it is always best to start with the basics.

Reason to manage your finances

1. To stay profitable:

Staying profitable should be your biggest goal. Being profitable can help alleviate some of the stress of being in business.

2. Make Informed Decisions:

You can make better and more informed decisions by having a clear understanding of your financial situation.

3. Plan for the future:

Planning for the future without knowing where you stand financially is difficult. However, with a sound financial plan, preparing for the future and the business’s overall goals is much easier.

4. Legal and Regulatory Requirements.

Many small businesses are required to maintain accurate financial records and tax returns; failing to do so can result in financial penalties. If you need a small business loan, you must be sure you are up to date with all legal and regulatory requirements.

5. To Secure funding:

If you need to borrow money for your business or want to get a small business loan, you will be required to show solid financial management. As a small business owner, you need to show the lenders you have a good understanding of how your business works and your current financial picture at any time. Business loans can be an excellent way to smooth out the cash flow issues in every business’s day-to-day operations.

How To Manage Your Small Business Finances.

1. Set financial goals

Setting financial goals is essential to ensuring your small business’s success and growth. It provides a benchmark to track performance, measure progress, and make adjustments. Setting goals is best to be realistic yet ambitious; setting short-term achievable targets can help you reach long-term objectives easily. Consider your past performance, current resources, competition, and economic conditions as you define reasonable goals for your company’s future. Additionally, break down larger goals into smaller steps so that each can be tracked over time – small successes can lead to large rewards for your business.

How to set financial goals:

Step 1: Determine your current financial situation.

Do you want to know where you are now and your recent financial picture?

Step 2: Identify your financial objectives

Consider what financial objectives you want to achieve in the next quarter, six months, and yearly.

Step 3: Set specific, measurable, achievable, relevant, and time-bound (SMART) goals.

You are using intelligent criteria, feasibly setting goals, and moving down the path you want to achieve financially.

Step 4: Develop a plan to achieve your financial goals.

Once you have set your (smart) goals, create a plan to achieve them. You should include specific actions you need to do consistently to achieve your goals.

Step 5. Monitor your progress.

Regularly reviewing your goals and financial performance can help keep you on track. In addition, this can help you identify any challenges or setbacks to make adjustments to stay on track.

It is essential to set goals that are realistic and attainable. Aim for goals that stretch the business and are challenging but also achievable. Be prepared to adjust your goals as your business grows and changes and you are presented with different information.

2. Create a budget

Creating a budget for a small business is an essential part of running a successful enterprise. When developing a budget, it is important to consider both income and expenses so that your business can cover costs while also achieving its goals and objectives. To get started, review any historical financial performance or profitability data to identify ways to direct resources from less profitable activities towards initiatives that produce better results. Another effective strategy is to allocate funds on the basis of time-bound priorities for the next fiscal year; this allows businesses to proactively tackle projects before demands arise. Finally, don’t forget to factor in risk management into your budgeting process; efficient ways to hedge risks are just as necessary as setting revenue-generating strategies. By taking the time to craft a realistic budget that takes cash flow, profit targets, and potential risks into account your small business will be one step closer towards continued growth and success.

3. Keep accurate financial records.

Keeping accurate financial records for your small business is key to being successful. By having an up-to-date and reliable record of all expenses and income, it will be easy to make sound financial decisions in the present, as well as keep track of how the business has grown over time. Additionally, accurate financial records help with filing taxes accurately and on time every year. Business owners can then use their financial records to plan strategies for future growth, including forecasting cash flow or investigating ways to cut costs. Keeping accurate financial records allows you not only to monitor the health of your business, but also stay ahead of potential challenges.

Financial reports like a balance sheet are critical to helping you manage your small business finances. When learning how to manage your small business finances it is important to familiarize yourself with all the different financial reports available to you.

4. Understand your financial statements

Knowing how to read financial statements is a necessary skill for business owners and those in charge of managing finances. It allows you to understand the full scope of your company’s financial health and determine if any changes need to be made in order to maintain it. Being familiar with financial statements also helps you recognize opportunities for growth, maximize earning potential, and develop an effective long-term financial strategy. To ensure that you are making the most informed decisions possible, stay up-to-date on all the relevant financial information available from your statements. One of the most important statement is a cash flow statement, this statement gives you an overall picture of what your current cash flow statement is.

5. Monitor your cash flow

Knowing your business’s cash flow is essential to make sure you’re meeting your financial responsibilities. Keeping tabs on the inflows and outflows of cash from a business helps owners and entrepreneurs anticipate where future expenses and profits may be headed. It’s important to understand when payments are due, money is coming in from various sources, what spending is mandatory, and what expenses can wait. By having an active understanding of the cash flow within a company, it will enable executives to make informed decisions about their finances in the present moment as well as in the future.

6. Manage accounts receivable.

Keeping track of money owed to your business and following up on any overdue payments is key to successful cash flow management. Accounts receivable (AR) begins with invoicing customers promptly, as invoices should be sent as soon as a sale is made. Monitoring AR on a regular basis also helps with maintaining accurate accounts, tracking trends in delayed payments over time, and understanding the business’s financial health. Additionally, setting expectations in advance with customers increases the likelihood that they will pay on time – for instance, letting them know your payment terms or having them commit to acknowledged debt. Following up on any overdue payments can help you to recover unpaid debits and maximize revenues. By putting these steps into practice and taking control of account receivables, businesses can save time and decrease the amount of money owed while protecting their cash flow position.

7. Manage Counts Payable.

Monitoring and managing accounts payable is essential for running a successful business, both from a financial and a customer relationship standpoint. By staying on top of your business’s outstanding bills, you can ensure that payments are made on time to avoid late fees and maintain good relationships with suppliers. Spending the time to monitor accounts payable will also help keep an accurate record of spending, allowing you to stay within established budgeting standards and allocate resources most efficiently. This proactive approach will help you build strong relationships with your suppliers, leading to better pricing on future orders as well as discounts for paying bills promptly. Taking the time to manage accounts payable can truly enrich your business operations in both tangible and intangible ways.

8. Manage profitability

Knowing how profitable your business is at any given moment is crucial for success. Staying up to date with revenue and costs should become a habit and be monitored closely in order to identify areas where revenue can be maximized or costs fronted. To do this effectively, run regular reports that compare income against expenditure and look for potential sources of improvement such as renegotiating contracts or raising prices. Keeping track of profitability ensures that you have an accurate picture of the health of your business and allows you to make better decisions as it progresses.

9. Control costs

Controlling costs is essential for the success of any business. It’s important to stay on top of expenses, and there are a number of ways to do this. Negotiating better terms with suppliers is one option; this may lead to a reduction in input and operational costs that can have a positive impact on your bottom line. Additionally, reviewing processes and finding more efficient ways to run your business can help you reduce expenses while still providing excellent customer service and products. Making sure you understand where every penny goes will ensure that you control costs and keep your business running smoothly.

10. Manage inventory

Managing inventory is an essential part of keeping a business running efficiently and profitably. By staying on top of how much inventory you have in stock, you can ensure that your consumers always have access to the products they need when they need them, which is critical for the success of any business. Regularly evaluating inventory levels and adjusting ordering practices accordingly will not only help you avoid having too much or too little, but will also save time and money by avoiding overstocking or costly back orders. An effective inventory management strategy, as well as tracking systems such as bar coding or software, can make managing your inventory easier, so it’s important to take the necessary steps to ensure that your team is equipped with the right tools for a successful operation.

11. Understand your Taxes

Knowing the ins and outs of your business taxes is absolutely essential for success as a small business owner. It’s important to stay on top of all the different types of taxes you will be paying and to make sure that they are paid on time. Being aware of the tax laws in your particular state—as well as staying up-to-date on any changes—can save you from potential legal complications and financial penalties down the road. Having comprehensive understanding of the tax requirements for your business is a necessity and an invaluable asset, so take time to get familiar with them and ensure your taxes are being handled correctly.

12. Protect your business assets

Proactively protecting your business’s assets is one of the most important investments you can make. Investing in insurance policies and security measures can ensure that your business investments are safeguarded, saving you time and money in the long run. From warning employees not to give away sensitive information on social media accounts to making sure cyber security software is regularly updated, there are a range of strategies that businesses can use to safeguard their assets. As it is so difficult to predict when or where an attack or unforeseeable circumstance might occur, it makes sense to invest in protection now rather than being reactive after an incident takes place.

13. Manage your business debt

As a business owner, debt can be a necessary part of running and growing a company. However, it’s important to closely monitor your debt obligations and strive to pay off high-interest debt as soon as possible. Neglecting to do so could result in severe financial strain down the road. Establishing sound processes for managing your debt can help you keep an eye on any changes in net worth, interest payments, repayment plans, and other key metrics. Set aside time each month to review your debt load and ensure that you’re staying on track with payments when applicable. Having an understanding of how your business is financing its operations can unlock new opportunities for growth – all while saving money with lower interest rates or more favorable repayment terms.

14. Use Financial software

Automating financial tasks with the help of financial software can be a great way to help streamline your business. Not only can it make it easier to track your finances, but it can help reduce the chance of mistakes by taking some of the burden off of you or any staff that might be involved. Research software options to find the best fit for your business and be sure to prioritize ease of use over overly complex capabilities so that you get the most out of this technology. It’s an invaluable tool for modern businesses and can be a great way to increase your profit margins.

15. Seek Professional Advice

Running a business can be stressful enough without having to worry about finances that may be difficult to understand. To make sure your business is headed in the right direction, it is important to seek advice from a financial professional like a accountant or financial planner. These expert professionals have the knowledge and experience needed to ensure that your finances are managed effectively and with accuracy, providing you with overall financial peace of mind. Taking advantage of their services could help save time and avoid costly mistakes as well as give you insights on how best to manage your business’s income and expenses for long term success.

16. Monitor financial trends

Staying ahead of financial trends is one of the most important aspects of successful business management. Companies should always be aware of economic conditions that could have an impact on their bottom line, such as changes in interest rates or shifts in customers’ spending patterns. Monitor key news sources to anticipate market movements, and stay ahead of competitor actions and the prevailing industry climate. Regularly review your own business finances and use a professional advisor if necessary to help you spot potential warning signs before they become problems. With diligent tracking, you can be ready to act quickly when unpredictable financial shifts present themselves.

17. Develop a financial contingency plan.

Developing a financial contingency plan is key to having peace of mind and staying protected in cases of emergency or unexpected events. Setting aside funds for a rainy day will allow you to ensure that you are able to cover living expenses, financial obligations, and other necessary payments in times of distress. For more complex needs, a plan for how to handle financial challenges may be the better choice. Determining your current and future financial needs, finding ways to generate additional income, building an emergency fund, consistently budgeting and analyzing where changes could be made – these are all aspects that should be considered when developing a contingency plan. Doing so will help lessen the stress that comes with tackling unplanned financial difficulties.

18. Understand your financial risks

Identifying and managing financial risk is an essential step in running any successful business. Risk assessment should form part of your planning process to give you a clear understanding of the potential outcomes associated with different decisions and strategies. Staying informed about current market conditions, government regulations and competitive trends can help you anticipate potential risks and allocate resources accordingly. It’s also important to have processes in place for measuring the success of your risk management procedures, so that corrective action can be taken quickly whenever necessary. When it comes to financial risk, having adequate strategies in place for minimizing losses can be key for keeping your business profitable and sustainable.

19. Use financial ratios

Financial ratios are an excellent way to evaluate the overall financial health of your business. Measuring factors such as debt-to-equity and current ratio can provide you with an in-depth understanding of where your company stands and how it is performing financially. They allow you to make strategic decisions about improving or maintaining your current level of success. Knowing how much debt you have in comparison to the equity from investments, or how much money is coming in versus what’s going out, gives you the data needed to ensure a strong financial future for your business. Taking the time to calculate these ratios is essential for any manager who wants to ensure they continue making sound financial decisions.

20. Review and update your financial plan regularly

Establishing a financial plan is one of the most important steps that any businessperson can take, but it’s also essential to regularly review and update your plan to keep up with changes in the marketplace and keep you focused on your current goals. Whether you’re managing a large or small business, or even if you are just starting out, it’s critical to check in periodically with your finances to make sure costs aren’t slipping through the cracks and that short-term objectives remain achievable. A financial plan should be continually updated not only for practicality but for accuracy as well — taking stock of your resources gives you a better sense of how viable each individual goal is and where possible optimizations can be made. Ultimately, reviewing and updating your financial plan is an investment in the future success of your organization — don’t neglect it.

Pick A Method Of Accounting

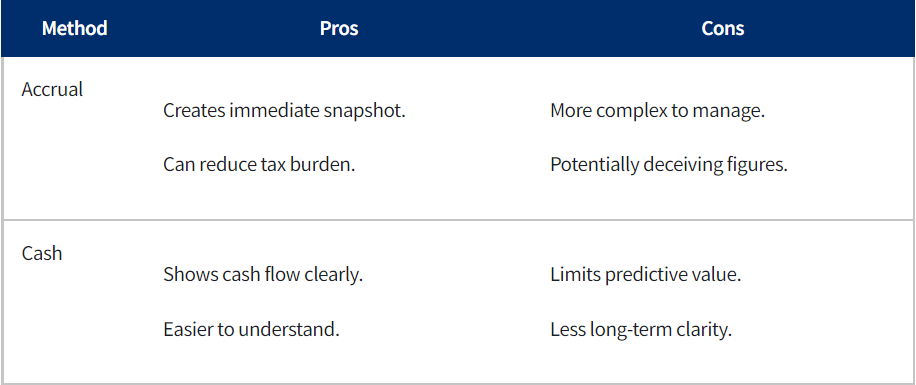

Businesses often use different methods of accounting to record purchases. The accrual method put the transactions on the book as immediately after completing the sale. The cash method only records the transaction once the payment has been received.

Accrual accounting

Accrual accounting is a method of accounting that records financial transactions as they occur rather than only when they are received or paid. This method helps small business owners get a more accurate picture of their finances and make better-informed decisions. Understanding the concept of accrual accounting and implementing it through double-entry bookkeeping can help businesses track expenses and revenue in real-time, helping them better plan their future financial activities and stay organized. Although it requires more time and effort than cash basis accounting, accrual accounting will be worth the additional energy when it enables you to understand your true financial position.

Cash Accounting

Cash basis accounting is an effective method for small businesses owners to manage their finances. It works by tracking business transactions when they occur and record them in the general ledger based on when the cash changes hands. This can be especially beneficial for businesses that don’t have a lot of cash flow and require a simplified way to manage their books. Cash basis accounting allows them to accurately record sales and pay expenses without having to worry about complex journal entries or purchase and depreciation records. Additionally, it provides key insight into cash flow and lets business owners know where their money is going at any given time, thus allowing them better control over spending. For companies starting out or looking for ways to simplify bookkeeping, cash basis accounting can be a great choice.

7 Essential Financial Management Tips For A Small Business

Tip 1: Separate your personal and business financial accounts

Keeping a separate business and personal financial account is an important part of establishing yourself professionally. When professionals have multiple income streams, keeping the lines between the two separate can be beneficial for tracking your success and potential growth. Separating those accounts can also help prevent potential audits by maintaining transparency regarding where finances are coming from and going to. Lastly, it’s important to maintain a professional outlook with banking institutions which can be achieved in part by having designated accounts for each purpose. By separating your business and personal financial accounts, you will not only maximize potential profitability but also appear more credible to potential clients and partners.

Tip 2: Set up a separate business checking account

Separating business finances from personal finances is essential in managing the cash flow of your enterprise. A dedicated business bank account helps entrepreneurs to better understand what the money in their company is being used for and makes financial planning simpler. It also allows you to more easily keep accurate records, which are necessary come tax season. Additionally, having a bank account specifically for business keeps your own funds secure, since money moves through one account for all expenses – meaning you don’t need to worry about diversifying it. Setting up a separate bank account is an organic step an entrepreneur must take in order to help protect and grow their business.

A Business savings account is important to save some money for your business for a rainy day. This is the best way to stay ahead with your cash flow.

Tip 4: Apply for business credit cards

If you are a business owner, getting a business credit card could be the best move for your money management and operations. Having a dedicated business credit card provides financial segregation, helping to better manage your operating costs and keep you organized for tax purposes. You’ll often find that business credit cards also offer higher limits than personal cards do, plus you can take advantage of promotional financing options with some cards. Ultimately, having a business credit card on hand offers convenience when it comes to making necessary purchases, plus the rewards add up quickly over time; its a win-win situation!

Tip 5: Pay yourself

It is easy to forget to pay yourself when managing finances, but setting aside money should be one of your main priorities. Paying yourself first is a key element in establishing and maintaining financial stability throughout your life. The benefit of this approach is that it helps guard against impulse purchases, as you already have money set aside for savings or investment. In addition, you can use this technique to increase your flexibility by selectively increasing or decreasing the portion of disposable income that you allocate toward the payment of yourself over time. Doing so leads to better decision-making when either unexpected opportunities or adverse events arise and encourages you to always keep an eye on your future selves’ financial goals. This practice also creates positive habits and makes it easier to secure a sound economic footing in good times and bad. Taking care to pay yourself first will only serve as part of your overall strategy for financial success.

Tip 6: don’t forget to set aside money for taxes

Setting aside money for taxes is an important step for entrepreneurs or anyone who is self-employed. To ensure you have the funds available when tax time rolls around, it’s wise to develop a plan for setting aside tax money on a regular basis. Doing so will give you some breathing room as taxes come due and avoid any potential issues with the IRS. One approach is to estimate your total liability each calendar quarter and have a set amount of money automatically withdraw from your accounts into a savings account specifically dedicated to taxes. This will help ensure there’s enough cash available to pay your bill in full when tax time arrives. With a little planning, setting aside funds for taxes can be easier than many anticipate.

Tip 7: Plan ahead

Planning ahead for the future of your business finances is essential to long lasting success. With thoughtful planning, you can identify opportunities and threats in advance which will help you secure growth and stability. You can also create a budget that’s both realistic and optimistic, allowing you to stay focused on your goals while still reacting to changing circumstances. Additionally, having detailed projections and forecasts can give you an idea of how prepared you are for the unexpected. Successful financial planning helps you to increase your profits and maximize potential returns, giving you better overall financial health for the foreseeable future.

Leave a Reply